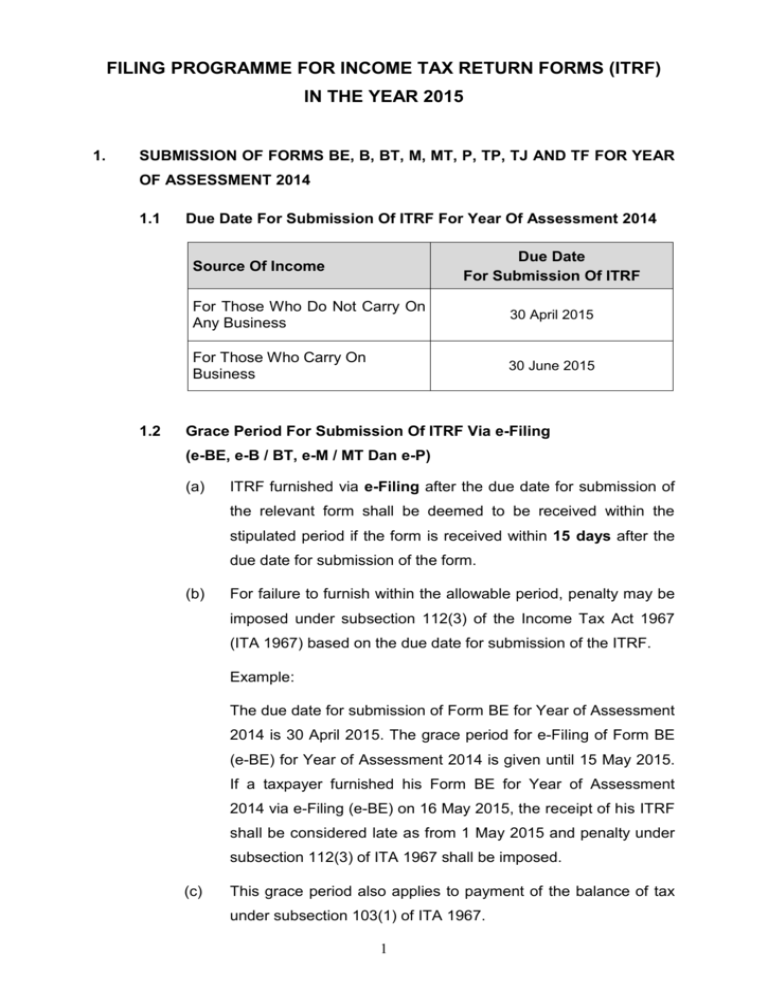

SCHEDULE ON SUBMISSION OF RETURN FORMS FORM TYPE CATEGORY DUE DATE FOR SUBMISSION E 2019 Employer 31 March 2020 BE 2019 Resident Individual Who Does Not Carry On Any Business 30 April 2020 B 2019 Resident Individual Who Carries On Business 30 June 2020 P 2019 Partnership BT 2019 Resident Individual Knowledge Worker Expert Worker. Tax season is here.

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

All partnerships and sole proprietorships must now file this form as well.

. IRBM LHDN will not entertain or accept any companies E filling 2021 that submit their Form E by hand or by mail. Due date to furnish Form E and CP8D for the Year of Remuneration 2021 is 31 March 2022. Ini termasuklah borang E BE B M MT P TF dan TP.

Anda boleh login ke dalam sistem e-Filing dengan layari. We have located the specific links to these forms for easy download. If the prefill data is not submitted before that date the employer is required to submit the CP8D data together with the Form E in the prescribed format or via e-Filing.

Cross-check all E forms information to. Senarai Pelepasan Cukai 2021 LHDN. Before submitting Form E to LHDN you will need to prepare Form E to print for e-Filing.

Majikan yang aklumat melalui e-Data Praisi tidak perlu mengemukakan Borang CP8D. After submitting your letter your form Borang A should be deleted within 21 days. A Borang E hanya akan dianggap lengkap jika CP8D dikemukakan pada atau sebelum 31 Mac 2020.

Select e-Borang under e-Filing. Rasmi LHDNM 1 Tarikh akhir pengemukaan borang31 Mac 2020. Membership lasts for one year from the date of the most recent qualifying donation.

30062022 15072022 for e-filing 6. Kemudian pergi ke bahagian. May 15 for electronic filing ie.

To facilitate taxpayers use of e-Filing in line with current. The due date for submission of the REITs RF Form TR for Year of Assessment 2022 is 31 December 2022. For date prompts of dd-mmm-yyyy please use 2-digit day 3-letter month abbreviation and 4-digit year.

To help you along you can refer to the steps in this guide. B Kegagalan mengemukakan Borang E pada atau. Click e-Form under e-Filing.

Form B Income tax return for individual with business income income other than employment income Deadline. 31032022 30042022 for e-filing 4. Fill in this form with the details required which include the date of your business the type of your business and the business codes.

General Form E submission deadline. Grace period is given until 5 January 2023 for. Form BE Income tax return for individual who only received employment income Deadline.

Login e-Filing Portal HASiL. E 2020 Employer 31 March 2021 BE 2020 Resident Individual Who Does Not Carry On Any Business 30 April 2021 B 2020 Resident Individual Who Carries On Business 30 June 2021 P 2020 Partnership BT 2020 Resident Individual Knowledge Worker Expert Worker 30 April 2021 does not carry on any business. April 30 for manual submission May 15 for electronic filing ie.

Form e-E All companies must file Borang E regardless of whether they have employees or not. I Submission of a Complete and Acceptable Form E a Form E shall only be considered complete if CP8D is furnished on or before the due date for submission of the form. Mulai 1 Mac 2022 kini pembayar cukai boleh mula mengemukakan Borang Nyata Tahun Saraan 2021 dan Tahun Taksiran 2021.

Form E submission process. Any dormant or non-performing company must also file LHDN E-Filing. Many of the Income Tax related forms are quite difficult to find.

Within one month after the due date 30 April 2021 Important Notes. April 30 for manual submission. 30042022 15052022 for e-filing 5.

The e-Filing system will be opened from 1st March 2021 and the submission deadline for e-BE YA 2020 is on the 30th April 2021. Please be informed that the Prefill Data System will be closed commencing 22022014. Filing of Return Form of Employer Form E must submit together with CP8D Form.

Go to Payroll Payroll Settings Form E. Once it is deleted you may submit the amended Borang A. Essentially its a form of declaration report to inform the IRB LHDN on the number of employees and the list of employees income details and must be submitted by 31st March of each calendar year.

Program Memfail Borang Tahun 2009 Dan Isu

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

What Is Cp22 Cp22a Where To Download Cp22 Cp22a Sql Payroll

What Employers Must Know About Form E Submission 营商攻略

Max Co Chartered Accountants Posts Facebook

Max Co Chartered Accountants Posts Facebook

What Employers Must Know About Form E Submission 营商攻略

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Lhdn Officially Announced The Deadline For Filing Income Tax In 2021 Attached Is A Guide To Tax Filing Online Everydayonsales Com News

Malaysia Tax Guide What Is And How To Submit Borang E Form E

What Is Form E What Is Cp8d How To Amend Cp8d Or Resubmit Cp8d

How To Use Lhdn E Filing Platform To File Ea Form Borang Otosection

Deadline For Malaysia Income Tax Submission In 2022 For 2021 Calendar Year L Co

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022